What Credit Score Do You Need For Dental Implants

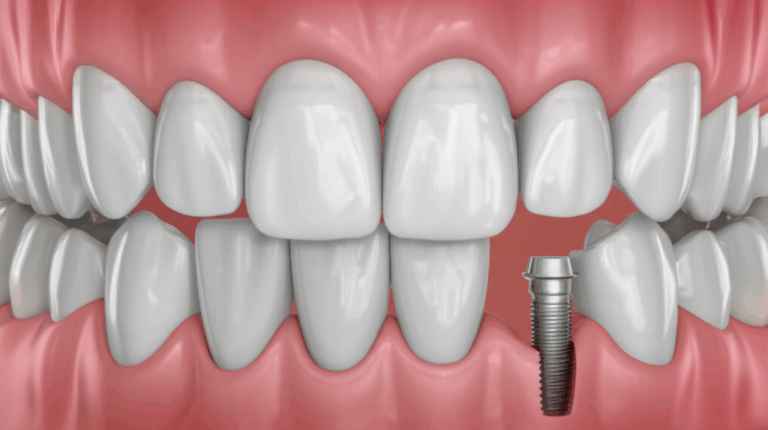

Dental implants can make a big difference in your life, but there’s one thing many people worry about—credit. Wouldn’t it be helpful to know what credit score you need for dental implants, and see how you can get approved, even if your score isn’t great? In this post, I’ll explain everything in simple terms: what lenders look for, how to improve your chances, tips from real people, and honest advice from someone who’s really looked into it. When you finish reading, you’ll know what to expect, what’s best, and how you can move forward—no matter what your credit is right now.

Article Outline

- What’s The Minimum Credit Score For Dental Implants?

- Why Do Credit Scores Matter For Dental Implants?

- Can You Get Dental Implants With Bad Credit?

- What If I Don’t Know My Credit Score?

- Which Dental Financing Options Check Your Credit?

- Do All Dentists Look At Credit The Same Way?

- Is There Help For Dental Implants If I Have No Credit?

- How Can I Improve My Chances Of Financing Approval?

- Can Insurance Or Discount Plans Lower My Costs?

- Are There Alternatives To Traditional Dental Implant Financing?

- What Role Do Dental Labs Like china dental lab Or zirconia lab Play?

- Key Points To Know Before You Apply

What’s The Minimum Credit Score For Dental Implants?

I remember being really nervous the first time I started to learn about dental implants. The big question in my head was, “What credit score do I actually need?” Most loan companies want to see at least a 600-650 credit score if you’re using a regular dental loan or credit card. Some will try to help people with lower scores, but you might have to pay more in interest or find someone to co-sign with you.

If your score is above 700, you’ll probably get better deals, longer to pay things back, and lower interest rates. It’s a lot like getting a car loan or money for fixing your house—the better your score, the more choices you have. Just remember, some companies that work just with dental or medical loans, and often help dentists and even some 3d dental labs, might bend the rules a bit more, so don’t give up if your credit isn’t the best yet.

Bottom line: If your score is in the low 600s or more, you have a chance. If it’s lower, don’t lose hope! You just need to try other ideas or bring extra paperwork.

Why Do Credit Scores Matter For Dental Implants?

Let’s be honest: dental implants cost a lot. Most of us don’t have thousands of dollars sitting around for a new tooth. That’s why your credit score matters. When you ask for dental financing, companies look at your score to see if you’re risky. They want to know if you pay bills on time, have a lot of debt, and if you handle borrowing well.

It might feel unfair, but they’re trying not to lose money. If you’ve been late paying or owe a lot, lenders get worried. That makes the whole thing feel scary or even wrong. And here’s the tough part: if you need good dental care, especially from a high-quality zirconia lab or emax dental lab, you want the best results. But credit checks can make people worry about whether they can even get treatment they really need.

Don’t let it stop you—there’s still hope even if your score isn’t perfect. Here’s why.

Can You Get Dental Implants With Bad Credit?

This question confused me for a long time. Bad credit makes things harder, but it doesn’t mean you can’t get dental implants. Many dentists will work with people with not-so-great credit. Sometimes, they set up their own payment plans, so you pay a smaller amount each month or over a year. Some dental financing companies help people with low scores too, but the interest is higher.

Another idea: patient help programs, charity groups, and in-office payment deals can help a lot. For example, a dentist who uses a local 3d dental lab might charge a little less or let you pay over time if you ask. If you’re really stuck, you can bring in a cosigner, like a family member or friend, who has better credit.

It isn’t always easy like just getting a simple “yes” from a bank, but if you don’t give up and are upfront, you can still fix your smile.

What If I Don’t Know My Credit Score?

You can’t plan for dental payments if you don’t know your credit score. A lot of people I talk to didn’t know their score until they tried to get a loan—and were either surprised in a bad way or a good way! Here’s what I suggest: check your score first. You can get a free copy once a year at AnnualCreditReport.com, and there are many phone apps or banks that give you your score for free.

Once you have your number, you know where to start. If you’re “fair” to “good” (about 600-700), try normal finance companies first and see what they offer. If you’re “poor” (under 600), get ready with another plan—like using the office’s own payment option or getting a cosigner.

It’s much easier to start with clear info. Think of it like a checkup at the dentist—a quick look now saves you trouble later.

Which Dental Financing Options Check Your Credit?

Most of the big dental loans or health credit cards will look at your credit score. CareCredit is a popular one—it works like a credit card just for medical stuff. They’ll check your credit to see if you can get it. Other companies, like LendingClub and United Medical Credit, do the same.

Still, not all payment plans care about your credit. Some dental offices and stand-alone 3d dental labs give you their own payment plans, sometimes with no official credit check at all. Ask your dentist what they offer—you could be surprised at what’s possible.

It’s kind of like buying a car. Dealers want you to buy, so sometimes they really try to help you find any way that works.

Do All Dentists Look At Credit The Same Way?

No two dental offices are exactly the same about credit. Some have tough rules—if your score isn’t high enough, you can’t get approved. Others, especially ones who work closely with labs or suppliers, try to find a way for you. I’ve even heard dentists fight for their patients with lenders, or make special payment plans, just so their patients get the help they need.

Best thing to do? Just ask. Be honest about your score and see what can happen. If you’re nice and keep checking, a lot of dental offices will show you secret options. They might also know local help programs, or suggest a reliable china dental lab for cheaper choices.

Remember, dentists want to help you smile. Being open with them can really help.

Is There Help For Dental Implants If I Have No Credit?

No credit isn’t the same as bad credit, but it can still make things tricky. Lenders don’t know how you pay bills, so they worry. But lots of young adults—or people who’ve always used cash—start this way.

If you don’t have credit, try other ideas. Some dental offices have “starter” payment plans for new patients. These let you pay a little at a time without a regular loan. You can also look into community health clinics, dental schools, or even ask about working with a more affordable china dental lab to save money.

Also, you can start building some credit before you apply for a dental loan. A small secured credit card or little loan paid off quickly can help. It’s like learning to ride a bike—shaky at first, but you’ll get the hang of it.

How Can I Improve My Chances Of Financing Approval?

This is where things really start to change. If your score isn’t what you want, small steps can help a lot. Start by paying off any old bills, even a small amount. Catch up on anything late and keep card balances as low as possible.

You can ask your credit card company for a bigger limit (but don’t use it)—this helps your credit score look better. Don’t apply for a lot of new loans all at once because each one makes your score drop a little.

Another good idea: get prices from many dental offices. Costs are often very different, especially if your dentist uses a fancy zirconia lab or emax dental lab for your work. You could save money, making it easier to get approved for a loan.

Sometimes, just telling your story helps. If your credit problems are old and you’ve been good lately, lenders might give you a break—especially for something important like fixing your teeth.

Can Insurance Or Discount Plans Lower My Costs?

I used to think my dental insurance would cover everything, but I was wrong! Most regular dental insurance just pays for small parts of implants (like a cap or pulling a tooth). The main implant piece, which a lab like a 3d dental lab makes, is sometimes not covered at all.

But dental discount plans might help. These are like club cards that give you lower prices at some dentists or specialists, cutting your bill by 10% to 60%. Not all dentists use these, but bigger offices usually do.

At the very least, insurance or a discount card can lower how much you have to borrow—which makes it easier to get approved.

Are There Alternatives To Traditional Dental Implant Financing?

What if your credit still isn’t good enough, and you don’t want to pay a ton of interest? Don’t worry, you still have choices. You can use a flexible savings account (FSA) or health savings account (HSA) if you have one—these pay for dental work and use pre-tax money.

Some people borrow against their life insurance or even ask family or friends for help. Others make deals right with their dentist, dividing the bills into bigger chunks but with no interest at all.

You can also look up dental charity groups, mission programs, or clinics outside the country connected to 3d dental labs, like a china dental lab, which can be much cheaper.

No one solution is right for everyone, but there are always more ways to get the help you need.

What Role Do Dental Labs Like China Dental Lab Or Zirconia Lab Play?

Maybe you’re wondering what a dental lab has to do with paying for your implants. Here’s why it matters: the lab your dentist uses changes how much you spend. The best labs (like a zirconia lab or emax dental lab) usually cost more, but the implant looks better and feels real. Some dentists team up with labs overseas, like a china dental lab, to give you a break on the price—without losing quality.

When you’re talking about paying for treatment, ask your dentist where your cap, bridge, or other parts will come from. They might have ideas to save money, which helps when you’re trying to get approved for financing.

Knowing these details can help you ask for better deals—and really understand what you’re paying for.

Key Points To Know Before You Apply

I know this is a lot to take in, so here’s a quick list of the most important things before you ask for help with dental implant payments:

- Know Your Score: Check your credit first. It helps you pick the best choices.

- Shop Around: Look at many offices and payment plans before deciding.

- Ask Questions: Find out if your dentist uses a 3d dental lab, zirconia lab, or china dental lab.

- Don’t Panic About Bad Credit: You still have options—payments, cosigners, or even charity help.

- Clean Up Your Credit: Even a small increase can get you better deals.

- Insurance Or Discounts: Use these to lower the amount you need to borrow.

- Try Different Ideas: Personal or family loans, savings, or community help all work.

- Be Honest: Tell your story; people do want to help.

- Stick To What You Can Afford: Don’t agree to more than you can comfortably pay back.

Summary: Most Important Things To Remember

- Dental implant credit rules aren’t set in stone.

- Most loans want a 600–650 score, but you still have some room to work.

- If you have bad or no credit, you can still find help with payment plans, cosigners, or local programs.

- Dental labs (china dental lab, zirconia lab, emax dental lab, 3d dental lab) change the price—and how you can save.

- Make your credit report better before you apply, and be upfront with your provider.

- Looking around, asking questions, and using every option gets you closer to your new smile.

A healthy smile is possible. Don’t let credit score worries stop you. With the right info—and a bit of effort—you can get the dental care you really need.