How Much Does an Out-of-Network Dentist Cost? Understanding Your Options & Saving Money

Summary:

Many people dread seeing a dentist, and not just because of the drill. High costs—especially for out-of-network care—can leave you with a bigger ache in your wallet than your tooth. If you’ve ever wondered how much an out-of-network dentist will cost, what your insurance will cover, and how you can make smart choices to save money, you’re in the right place. Here, I’ll break down everything you need to know in simple language. You’ll feel ready to handle your next dental visit like a pro.

Table of Contents

What Does “Out-of-Network Dentist” Mean?

You might have heard this saying and wondered what it means. An out-of-network dentist is a dentist who hasn’t made a deal with your dental insurance company. These dentists set their own prices and don’t have to follow insurance company rules for costs.

When you go to an in-network dentist, your insurance has already set up a price deal with them, so you pay less. Out-of-network dentists don’t have such a deal—so you pay more.

Think of it like shopping at a store that doesn’t give you a discount for your rewards card. Out-of-network is kind of like that: no extra savings, and more cost for you.

Why Would I Choose an Out-of-Network Dentist?

Let’s talk about why anyone would go out of network—especially when money is tight.

Yes, out-of-network care costs more—but sometimes, your needs come first.

How Do Dental Insurance Plans Work With Out-of-Network Dentists?

Most dental insurance plans are either PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization).

- PPO Plans: These let you go to out-of-network dentists, but they pay less (about 30–70% of what’s “usual and normal”). You pay the rest.

- HMO Plans: These usually only pay for in-network dentists, unless there’s a real emergency.

How paying usually works:

It’s kind of like paying for dinner first, and then splitting the bill with a friend later.

What Key Terms Should I Know About Dental Insurance?

Dental insurance words and rules can be hard to follow, so let’s make them simple:

- Deductible: The amount you must pay each year before insurance starts helping. It’s like a ticket to get in.

- Coinsurance: The percent you pay for a covered service after your deductible is met (often 20–50% for out-of-network services).

- Annual Maximum: The most your plan will pay for your care in a year—usually $1,000–$2,000.

- UCR (Usual, Customary, and Reasonable) Fees: What your insurance believes is a fair price in your area for each treatment. If your dentist charges more, you have to pay the extra.

- Balance Billing: This is what really adds up. It’s the difference between the dentist’s price and what your insurance will pay for that work.

Knowing these words can keep ugly surprises off your bill.

How Much More Does Out-of-Network Dental Care Really Cost?

Let’s be honest. You usually pay more for out-of-network dental care than for in-network care. Why?

- Out-of-network dentists make up their own prices. These often run higher than what insurance companies want to pay.

- Insurance will cap what they pay by those UCR rates. Anything extra? That’s up to you.

- Insurance pays less for out-of-network care—so you get less back.

Think of it like ordering take-out from a fancy place instead of a fast food joint—better food, higher price.

What’s the Average Cost for Common Out-of-Network Dental Procedures?

To see real numbers, here’s a table with usual out-of-network costs and what insurance may cover:

| Dental Procedure | Average OON Cost | Insurance Pays | You Pay | Notes |

|---|---|---|---|---|

| Dental Cleaning | $75 – $150 | 60 – 80% | $15 – $60 | May be covered 100% in some PPOs after deductible |

| Exam | $50 – $120 | 60 – 80% | $10 – $48 | |

| X-rays (bitewing) | $40 – $100 | 60 – 80% | $8 – $40 | Full series costs more |

| Filling (1 surface) | $100 – $400 | 40 – 70% | $30 – $240 | Tooth-colored (composite) most expensive |

| Extraction (simple) | $150 – $450 | 40 – 70% | $45 – $270 | Impacted or surgical extractions cost more |

| Dental Crown | $800 – $1,800 | 30 – 50% | $400 – $1,260 | Material and tooth location impact cost |

| Root Canal (front tooth) | $700 – $1,200 | 30 – 50% | $350 – $840 | Molars cost even more |

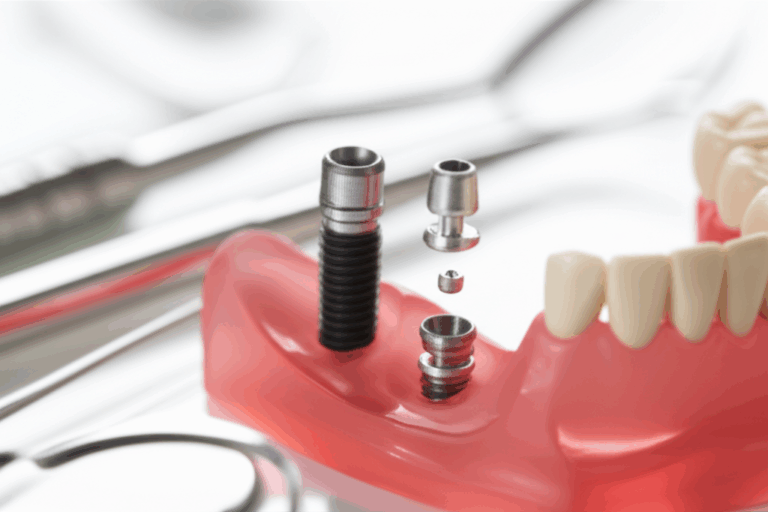

| Implant (single) | $3,000 – $6,000+ | 0 – 30% | $2,100 – $6,000+ | Insurance often covers little or nothing |

| Denture (full) | $1,500 – $3,000 | 30 – 50% | $750 – $2,100 | Custom fit, materials matter |

| Braces | $3,000 – $7,000 | 0 – 25% | $2,250 – $7,000 | Sometimes a separate max applies |

| Wisdom Tooth Extraction | $300 – $750/tooth | 30 – 50% | $150 – $525/tooth | More for impacted teeth and anesthesia |

Note: These are rough guesses. Your costs can go up or down based on your town, insurance plan, and dentist.

Example: If your child needs braces and the dentist is out-of-network, expect to pay a lot out of pocket. Only part of the total bill might be paid by your insurance, and maybe only up to a set limit.

What Factors Affect Out-of-Network Dental Costs?

Ever wonder why a filling costs more in some states? Dental costs can change for a few reasons:

- Where You Live: Big cities usually have higher prices than smaller towns.

- Type of Dentist: Dentists who only do certain things, like braces or gum work, charge more than regular dentists.

- Materials: Fancier crowns or white fillings cost more than the old silver kind.

- How Hard the Work Is: A simple tooth pull is quicker and cheaper than getting out a stuck wisdom tooth.

- Experience: Really skilled or well-known dentists might charge more.

Any of these things can make your bill bigger or smaller.

How Can I Estimate and Plan for My Out-of-Network Costs?

Don’t just guess about your bill. Here’s what you can do before your treatment:

- What’s my yearly deductible?

- What’s my part (coinsurance) for out-of-network care?

- Are there yearly or lifetime limits?

- What does “usual and customary” mean for the work I need?

Doing this early makes your bill less of a shock.

What Are Smart Ways to Save Money With Out-of-Network Dentists?

Dental bills add up fast, but here are ways to pay less:

- Talk and Ask: See if the dentist offers a self-pay or cash discount. Some will charge less if you pay right away.

- Check Out Payment Plans: Lots of dental offices let you pay a little each month, not all at once, for big jobs.

- Dental Savings Plans: Like a discount club. These usually cost less than real insurance.

- Use HSAs or FSAs: Pay with pre-tax dollars from a special savings account and save on taxes.

- Try Cheaper Clinics or Dental Schools: Dental diseases can often be fixed at dental schools for a much lower price. Dental students work under teachers with skill.

- Look Around: Prices change a lot between dentists. Get prices from a few, especially for expensive work.

Being smart with your choices can save you hundreds—or more—on dental care.

What Are the Pros and Cons of Out-of-Network Dental Care?

Think about what matters to you before choosing:

Pros:

- You can choose the dentist you like, even if they aren’t in your insurance network.

- Some experts and top dentists are only out-of-network.

- Small or private offices might spend less time on paperwork and more on you.

- In emergencies, you don’t have to worry about network rules.

Cons:

- You pay more, and often pay the whole bill first.

- You do more work: sending claims to insurance, waiting for money back.

- You might get “balance billed”—paying the extra cost your plan doesn’t cover.

- Your plan pays less for out-of-network work, and some things (like implants or braces) may not be covered at all.

It’s really about cost versus choice. Decide what matters most to you.

Frequently Asked Questions About Out-of-Network Dental Costs

Q: What if my dentist suddenly leaves the network?

A: You’ll go to out-of-network prices. Ask your insurance—sometimes they let you keep better coverage for a few months while you change.

Q: Does it ever make sense to stay with an out-of-network dentist?

A: Yes—if you really like your dentist, need a certain expert, or can’t find a good in-network one. Just plan for the bigger cost.

Q: Are all out-of-network claims paid back?

A: Not always. Your insurance can deny claims if they think the cost is too high or if they think you don’t need the treatment. Always check ahead.

Q: Can I use my dental lab of choice for crowns or implants?

A: Most dental offices send their work to labs they trust. If quality matters, ask if they use a dental ceramics lab or a good crown and bridge lab.

Q: Can dental laboratories help me save money?

A: Sometimes. Dentists using trusted lower-cost labs, such as a china dental lab, might pass the savings to you.

Main Points to Remember

- Out-of-network dental care usually costs more.

- You pay the extra cost (“balance billing”).

- Learn your insurance: deductible, coinsurance, yearly max, and UCR fees.

- Always get a price estimate and check your plan before you get treated.

- There are ways to save—ask about lower prices, payment plans, or affordable places.

- Sometimes, the best dentist for you isn’t in your network, and that’s okay—just plan for it.

Dental care doesn’t have to be confusing or painful for your wallet. With good questions and a little planning, you can keep your smile—and your bank account—in good shape.

For more help, check out these resources: teeth information, dental care, and teeth health.

References:

- American Dental Association

- National Association of Dental Plans

- Insurance company plan booklets

- Dental schools and clinics’ public pricing

- ADA Fee Schedule Reports