Does Medicare Part C Cover Dental Implants? A Kind Guide for Seniors

If you’re reading this, you’re probably facing a tough question: Does Medicare Part C cover dental implants? Maybe you or someone you care about needs new teeth, and you’re looking for answers, starting to feel a little lost with all the rules and costs.

First, you’re not alone. Dental implants can make life much better, helping you eat, speak, and smile without worry. But figuring out if your Medicare Advantage (Part C) plan will help pay for them… Well, it can be confusing for anyone.

In this guide, I’ll explain this tricky topic one step at a time. We’ll use simple words and clear examples so it’s easy to follow—even if you’re just getting started with Medicare. By the end, you’ll know just where you stand and what to do next.

In This Article

- The Quick Answer: Are Dental Implants Covered by Medicare Part C?

- What Is Medicare Part C? (Medicare Advantage Dental Benefits Explained)

- Dental Implant Coverage: The Real Story Behind the Fine Print

- What Factors Impact Implant Coverage With Medicare Advantage?

- How to Find a Medicare Plan That (Maybe) Covers Implants

- What If You Don’t Have Coverage? Smart Alternatives and Solutions

- Real Numbers: Typical Costs & Coverage Limits

- Who Should Get Dental Implants? (Are You a Good Candidate?)

- Key Takeaways: Your Dental Implant Decision Checklist

- FAQs About Medicare Part C and Dental Implants

The Quick Answer: Are Dental Implants Covered by Medicare Part C?

Let’s get right to it: Most Medicare Part C (Medicare Advantage) plans DO NOT cover dental implants as a normal benefit.

Shocked? You’re not the only one. Dental implant coverage is one of the most confusing and annoying areas for people with Medicare.

Here’s why:

- Implants are usually seen as “big” or “cosmetic” work, not basic care like cleanings or fillings.

- Most Medicare Advantage dental plans cover just preventive or basic dental services.

- If they do cover any major dental work, the yearly limit is usually $1,000 to $2,500—way less than the cost of even one dental implant.

But,* (and it’s an important but)—there are some exceptions. If your need for implants comes from a big medical problem, like fixing your jaw after an accident or cancer, some plans may consider paying for implants under special rules.

> Bottom Line: For most seniors, you’ll pay for dental implants yourself, unless you’re one of the few where a medical condition makes the implant “medically needed.”

What Is Medicare Part C? (Medicare Advantage Dental Benefits Explained)

Let’s go back for a second and clear things up. What is Medicare Part C, and how does dental fit in?

Medicare Part C in Simple Words

Medicare Part C is also called Medicare Advantage. Instead of getting Original Medicare (Parts A & B) from the government, you sign up with a private insurance company. These are the plans you see advertised by companies like Humana, UnitedHealthcare, Aetna, Cigna, and Blue Cross Blue Shield.

These plans combine all the regular Medicare benefits (hospital, doctor, drug coverage)—and sometimes extra things like dental, vision, and hearing.

How Is Dental Covered Under Part C?

Here’s the catch: Not all dental coverage is the same.

There are two basic kinds:

- Cleanings

- Regular X-rays

- Checkups

- Small fillings

- (Maybe) simple tooth pulling

- Crowns

- Root canals

- Dentures

- Sometimes big work like bridges or implant-supported dentures

- Hardly ever dental implants

Most Medicare Advantage plans cover just basic dental. A smaller number—maybe 20 to 40%—give more complete dental options (sometimes for an extra fee).

Even then, full coverage for dental implants is super rare.

Why Does This Matter?

Because Original Medicare (Parts A & B) doesn’t cover any normal dental care. So, if you need a dental implant and you only have Original Medicare, you’re out of luck unless it’s part of a hospital stay, like jaw surgery after an accident or cancer.

Dental Implant Coverage: The Real Story Behind the Fine Print

Now, let’s get to what you really want to know. Say you want a dental implant—maybe you lost a tooth, maybe more. You’ve heard about implants from your dentist or maybe read some implant dental laboratory info. So: Will your Medicare Advantage plan pay for it?

The “General Rule”: Implants Usually Aren’t Covered

Most Medicare Advantage dental plans call dental implants:

- Major dental work or

- Cosmetic treatment (not needed for your basic health)

Plans mostly care about “keeping you going”—cleanings, fillings, stuff that stops new problems. Implants, while amazing, are seen as something extra.

The Exception: Medical Necessity

There’s one main way to possibly get coverage. If dental implants are called medically needed because of:

- Bad facial injury (like a car crash)

- Jaw repair (after cancer surgery)

- Birth conditions (rare cases with missing jawbones)

…then, maybe, a Medicare Advantage plan will help pay for implants.

How It Works

To get dental implants covered for “medical need”:

- Your doctor and dentist have to send in lots of paperwork showing the implants are needed because of a real health problem—not just missing teeth.

- The insurance company usually wants pre-approval.

- It may have to involve a hospital or needed jaw surgery.

Even then, most plans only pay for a small part. You’ll probably still run into the yearly limit of $1,000-$2,500—which is only a bit of what an implant actually costs.

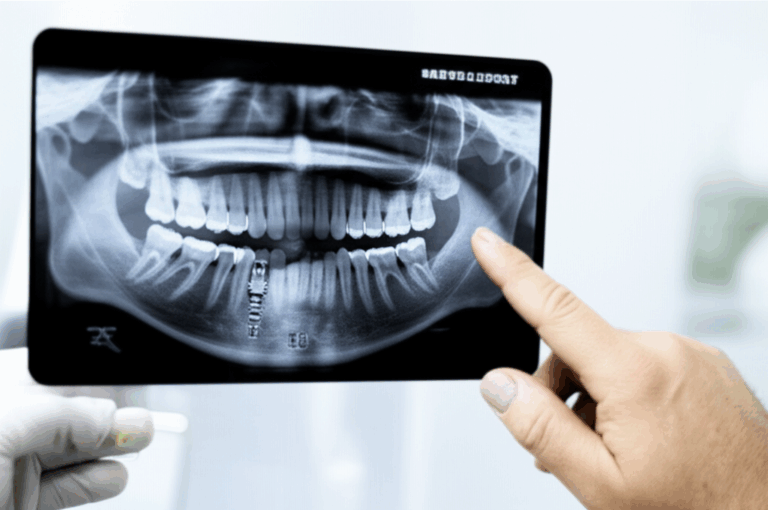

Original Medicare and Implants: Only If You Need the Hospital

In the rarest cases, if you need to stay in the hospital for jaw surgery because of cancer or a bad injury, Original Medicare (Part A/B) might pay for part of your hospital stay… but not for the dental implant itself.

What Factors Impact Implant Coverage With Medicare Advantage?

So, what makes a difference if your plan will pay for dental implants? Let’s look at the main things.

1. Your Plan’s Exact Benefits

Every Medicare Advantage plan is different. Don’t think that just because a friend’s plan paid for something, yours will too!

PRO TIP: Find your Evidence of Coverage (EOC) document. It shows exactly what’s covered and what isn’t.

2. Yearly Dental Benefit Limits

Most plans have a yearly limit for dental work, usually $1,000 to $2,500. Dental implants cost a lot. Even if covered, you’d use up that limit with just one implant.

3. Dentist Network Rules

Need a dentist for implants? You usually must use one in your plan’s network—especially with HMO plans.

Some plans let you see dentists outside the network (PPO plans), but it costs more and the dental limit still counts.

4. Deductibles, Coinsurance, and Copays

Even if dental implants are covered, you’ll need to watch out for:

- Deductible: What you pay first before the plan pays.

- Coinsurance: You pay a part (like 20-50%) of the cost.

- Copays: A set amount you pay each visit or job.

5. Pre-Approval

The insurance plan often needs to say “yes” before you get treatment. If you skip this, you might have to pay the whole bill—so always ask first!

How to Find a Medicare Plan That (Maybe) Covers Implants

It’s rare, but some Medicare Advantage plans do have options that might help with dental implants—usually through wider dental add-ons.

Where to Begin When Looking for a Plan:

- Try to find plans that promise “comprehensive” or “big” dental benefits.

- Some plans sell these extras for more money.

- They may include crowns, dentures, or maybe implant-supported dentures.

- Real implant coverage is still hard to find—read every detail!

- Call customer service.

- Ask clearly, “Do you cover dental implants at all? What about if they’re medically needed?”

- Brokers can compare plans in your area and might know about hidden plans with better dental cover.

> Keep in mind: Comprehensive dental might mean more than just cleanings, like crowns or bridges, but not always actual implants.

What If You Don’t Have Coverage? Smart Alternatives and Solutions

Most Medicare Advantage users hear “no” for implant coverage. But don’t worry—there are still ways to deal with the costs or find other options.

1. Stand-Alone Dental Insurance Plans

Some companies sell their own dental insurance just for big work—even implants. But:

- They often make you wait before you can use it for big jobs.

- There are still yearly limits ($1,000-$2,000 is common).

- Some plans still don’t cover implants. Read very carefully!

2. Dental Savings Plans

Think of these like discount clubs. You pay a fee once a year, and dentists in the plan offer cheaper prices—sometimes for implants.

- Not “insurance” – just deals.

- Good if you know you need a lot of work soon.

3. Medicaid (If You Qualify)

If you have low income, your state’s Medicaid might pay for dental implants in special cases—but most only cover basic dental.

4. Dental Schools

Dental schools near you might offer cheaper services for things like implants. Students do the work, but teachers watch closely.

- It takes longer than a normal dental office.

- It can help you save a lot.

5. Payment Plans and Dental Loans

Many dentists will let you pay for implants little by little, or work with lenders like CareCredit. This way, you get what you need now and pay over months or years.

6. Grants or Non-Profit Help

Some charities, dental help programs, or groups for veterans give help with dental implants. It’s rare, but worth a shot.

7. Alternatives to Implants: Dentures or Bridges

If implants are too expensive, regular dentures or bridges can bring back your smile for a lot less—and may be covered by Medicare Advantage dental benefits or normal dental plans.

Check all your choices before picking what’s best for your teeth and your bank account!

Real Numbers: Typical Costs & Coverage Limits

Want to see the numbers? Let’s be real.

Dental Implant Costs

- Single Implant: $3,000 – $6,000 for one tooth (post, connector, and crown)

- Full Mouth Implants (All-on-4, full set): $25,000 – $50,000+

- Denture (for comparison): $1,000 – $3,000 for one upper/lower set

(Data from the American Dental Association and top oral surgeons.)

Medicare Advantage Dental Benefit Limits

- Yearly Max Benefit (Normal): $1,000 – $2,500

- This is for ALL dental work that year, not just implants.

- What You Still Pay: Usually 20-50% of “big” dental jobs, if they cover it at all.

- Complete Coverage Plans: Only 20-40% of Medicare Advantage plans have “full dental.” Fewer even think of covering implants.

Who Gets Implant Coverage?

- Less than 5% of implant cases are covered for “medical reasons.”

- Over 90% of implant costs are paid by patients directly, not insurance.

What If You Have No Dental Coverage?

It’s more common than you’d think. In 2019, about 30% of people on Medicare had NO dental coverage at all—things are a little better now, but many seniors still have a big gap.

Who Should Get Dental Implants? (Are You a Good Candidate?)

Not sure if dental implants are for you? Here’s how to know.

Dental Implants Work Best For…

- Grown-ups with one or more missing teeth

- People with healthy, strong jawbones (not a lot of bone loss)

- Anyone wanting teeth that look and last like real ones

- People who don’t do well with dentures or bridges

Who Might Not Be a Good Fit?

- People with a lot of bone loss or gum disease (though bone grafting can help)

- Those with certain health problems (like uncontrolled diabetes, bleeding problems, or weak immune systems—ask your doctor)

- People who smoke now (smoking lowers the chance of implants working)

- Anyone who can’t go through a weeks-long or months-long process

> Example: A dental implant is like the base of a house. If your jawbone isn’t strong, the “house” can fall down. That’s why dentists need to check first!

What If Implants Aren’t for You?

Don’t stress. Removable dentures or dental bridges are more likely to be covered, cost less, and are easier to get if you aren’t the best match for implants.

Key Takeaways: Your Dental Implant Decision Checklist

Let’s finish up with an easy checklist to remember:

If you’re asking, “Does my Medicare Advantage plan cover dental implants?” just remember…

- Direct coverage is very rare. Most plans say no, or pay so little, you pay most of it yourself.

- Medical needs can be different. If tooth loss is from an accident, cancer, or jaw surgery, you might get coverage—but be ready to show proof.

- All plans are different. Don’t copy what someone else did—read your own rules before starting treatment.

- Look at all your options. Stand-alone dental insurance, savings plans, dental schools, easy payment plans, and dentures might all work better for you.

- Ask more! Talk to your dentist and insurance agent to be sure what’s covered. Get everything in writing.

- Your health comes first. Fixing missing teeth helps you eat, feel better, and even helps your heart. Even if you skip implants, take care of your mouth.

FAQs About Medicare Part C and Dental Implants

Q: What is the average out-of-pocket cost for dental implants with Medicare Advantage?

A: Almost everyone pays the whole amount—usually $3,000 to $6,000 for each tooth—as there is usually no coverage and the plan limits are small.

Q: Does Humana, Aetna, or UnitedHealthcare Medicare Advantage ever cover dental implants?

A: Some top “comprehensive dental” plans might offer some help, but with low yearly limits. Coverage for implants is still very rare, even from well-known companies. Always call and ask your plan.

Q: What about discount plans or dental schools?

A: Discount dental plans can save you 10-60%, depending on where you live. Dental schools usually charge less (sometimes one-third the regular cost), but you may need to wait longer for the work.

Q: If I have medical need (like cancer surgery), will the whole implant be covered?

A: Most times, only the pieces tied to the medical problem (like jawbone surgery) get paid for. The implant and cap are usually still called dental—and get denied or limited.

Q: What services are almost always in Medicare Advantage dental?

A: Cleanings, simple X-rays, checkups, and small fillings. Some also cover crowns, root canals, or dentures—but check your plan carefully, as it’s different by plan!

Small Steps, Big Smiles: Empowering Your Decision

Losing teeth can be scary—and expensive. But you’ve already made the first step by getting good info. Now, use what you learned:

- Look at your insurance paperwork.

- Ask every question you have—even small ones.

- Try all your choices: dental schools, discount cards, or other treatments.

If you want more info about dental diseases and conditions, or tips on keeping your teeth healthy, see our guides.

And most important—don’t wait to talk to your dentist. Together, you can find the best way to bring back your smile, boost your confidence, and keep your mouth in good shape for years.

Remember: Knowing more helps you make the best choice for your health, your money, and your happiness.