Does 32BJ SEIU Health Fund Cover Dental Implants? Your Complete, Compassionate Guide

That sinking feeling when your dentist says, “You need a dental implant”—it’s not just about the procedure. The real shock comes when you start to wonder, “Will my insurance help pay for this?” If you’re a 32BJ SEIU member, you’ve probably typed “does 32BJ cover dental implants” into Google, hoping for a simple answer. You’re not alone.

Dental implants can give you your smile, your bite, and your confidence back. But let’s be honest, they’re also one of the most expensive dental treatments. If you’re wondering what help your union plan gives, this article’s here for you.

Why Dental Implant Coverage Really Matters

You’ve lost a tooth. Or maybe you’re getting some pulled and your dentist is talking about choices. Suddenly, words like “implant,” “abutment,” and “annual maximum” start popping up. But none of this means much if you can’t afford it. That’s where your union dental benefits come in—or don’t.

Here’s the truth: a missing tooth is a big deal. It changes how you eat, talk, look, and feel—even keeps your jawbone healthy. Dental implants aren’t a “just for fun” thing—often, they’re the best way to feel normal after losing a tooth.

And as a 32BJ SEIU member, you need to know: what will your Health Fund do for you on this journey?

Table of Contents

1. Does 32BJ SEIU Health Fund Cover Dental Implants? The Real Answer

Let’s not beat around the bush: yes, many 32BJ SEIU Health Fund dental plans do help pay for dental implants—but there are lots of “but’s.”

Here’s what you should know right now:

- Coverage is usually only part of the cost. Don’t expect them to pay everything.

- It depends on your exact 32BJ plan. Different groups, states, or employers have different dental benefits.

- Implants are usually only paid for if you really need them for medical reasons. That is, to eat, talk, or stop jaw problems—not just to look good.

- Not every piece might be paid for. Sometimes the plan covers the implant post, the connector, or the crown. Sometimes just one. You pay the rest.

- There are yearly limits and things you pay first. After a certain amount in one year, you pay the rest.

So, can you get help for your implant with 32BJ? Probably, yes—but you must check your own plan’s details before doing anything.

2. What Decides Your Implant Coverage? (Simple Factors Explained)

Dental insurance—especially union plans—has a lot of details and small print. Here’s what matters most.

Plan Type: PPO vs HMO (and why it’s important)

A PPO (Preferred Provider Organization) is like a big group of dentists who agreed to charge less for members.

An HMO (Health Maintenance Organization) is a smaller group—you have to use their dentists, but prices are more steady.

Most 32BJ dental plans are PPOs. That usually means:

- You can go to any dentist, but staying with their dentists saves you money.

- You may get more help with implants if you use their dentists.

Medical Need vs Cosmetic

Implants are usually paid for only if insurance thinks they’re “medically needed”—meaning you need it to talk, chew, or stop jawbone problems.

Just for looks? Usually not paid.

Tip: Your dentist should write down why you need this implant. That’s part of asking for approval (more on that soon!).

Annual Maximums

Your plan pays up to a certain amount per year—call this the “cap.” After you hit it, you pay for the rest. 32BJ usually pays up to $1,500 to $3,000 a year, but your plan might be different.

Deductibles

You pay a certain amount at the start of each year before the plan pays. For big treatments, this could be $50–$100 per person.

Coinsurance

Coinsurance is how you and the plan split costs after your deductible.

For example, if the plan pays “half of big treatments,” you pay half and insurance pays half for the implant, up to your yearly cap.

Waiting Periods

Some plans make you wait—maybe 6 to 12 months—before you can get big treatments like implants.

What’s Paid For

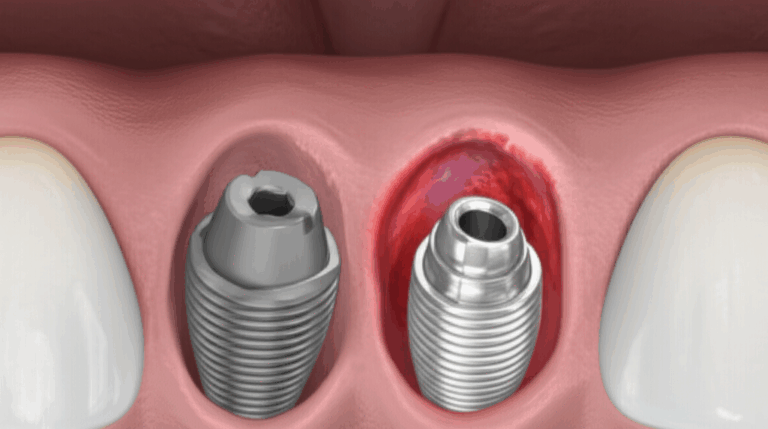

A dental implant happens in steps:

- Implant post — put into your jaw

- Abutment — connector to the crown

- Crown — the tooth cap you see

- Other things — bone graft, extractions, x-rays. Sometimes covered, sometimes not.

Not all plans pay for every step. Some pay only for the crown, not the surgery.

In-Network vs Out-of-Network

Going to one of the plan’s dentists means more savings—lower costs, bigger plan payments.

If you go outside, you’ll get less help.

3. How to Find Out About Your Own 32BJ Implant Benefits

Here’s what most people skip—but it’s the only way to get a real answer for you.

A. Read Your Summary Plan Description (SPD) or Booklet

Your SPD is your “how your insurance works” book. It tells you:

- What’s paid for

- What % is paid for implants

- Yearly caps

- Waiting periods

- What’s not paid for

If you don’t have one, you can ask the 32BJ Health Fund for it.

B. Use the 32BJ Member Portal

Most plans let you log in to a private website where you can check:

- How much benefit you have left for the year

- Past bills

- Which dentists are covered for implants

C. Contact 32BJ Health Fund

Call the customer service number. They can look up your exact plan and answer your questions.

Good questions to ask:

- Is my dentist in your plan?

- What % do you pay for dental implants?

- What’s my yearly cap and how much is left?

- Do I need you to approve the work before starting?

D. Ask Your Dentist to Send in a Pre-Authorization

Your dentist’s office deals with insurance every day. Have them send your treatment plan to 32BJ before you start—so you know what insurance will and won’t pay for. This keeps away bad surprises.

4. What Is Pre-Authorization, and Why Is It Important?

It’s like getting told ahead of time if a loan is approved—before you spend the money, insurance checks if your treatment is allowed.

Why it matters:

- Stops surprise bills

- Tells you ahead what’s paid

- Shows your part to pay

How it works:

Pre-authorization is a must for big treatments like implants. Skipping it can mean insurance won’t pay.

5. Getting the Most from Your 32BJ Dental Implant Benefits

Dental work—especially implants—can be pricey, even with help. Want to keep your costs down?

Use In-Network Dentists

This is a big one.

In-network dentists have agreed to charge less, and the plan pays more.

Plan Big Treatments Over Time

If your yearly max is $2,000, but your dental implant will cost $4,000, see if you can split the work so some’s done this year and some next year. You could get more help this way—if it’s safe for your mouth.

Keep Up with Checkups

Taking care of your other teeth means less work (and cost) later. Cleanings and checkups are usually paid for and keep away bigger problems.

Ask About Paying the Rest

Even with insurance, you may owe some. Ask your dentist if they offer payment plans, health savings, or special discounts for 32BJ members.

6. Limits and Exclusions—Stuff to Watch For

Dental insurance is full of “gotcha” rules. Here’s what to watch:

Implant Types

Not every type or method is covered. Fancy techniques or rare materials may not be paid for.

“Missing Tooth Clause”

Some plans won’t pay for an implant if you lost the tooth before you were insured.

Check your SPD or ask about this.

Limits on Number or How Often

You may only be allowed so many implants or big treatments in your life or over a few years.

Looks vs Function

Implants just to look better (with no chewing or talking need)? They might not pay.

Yearly Limits

Most plans have yearly caps—usually $1,500–$3,000. When that’s gone, you pay, even if the plan says “50% should be paid.”

7. Other Ways to Replace Teeth (and if 32BJ Pays)

Implants aren’t right, or affordable, for everyone. Here’s how other options line up, plan-wise:

A. Dental Bridges

A bridge uses crowns on teeth next door to fill the gap.

- Usually more covered (often 50–80%).

- Cheaper than implants, but may not last as long.

B. Partial Dentures

Removable pieces with a few teeth.

- Typically get good coverage.

- Cheaper, but some people find them less comfy.

C. Full Dentures

For folks missing all teeth on the top or bottom.

- Standard benefit in most union plans.

- Take some getting used to; may not feel as real as implants.

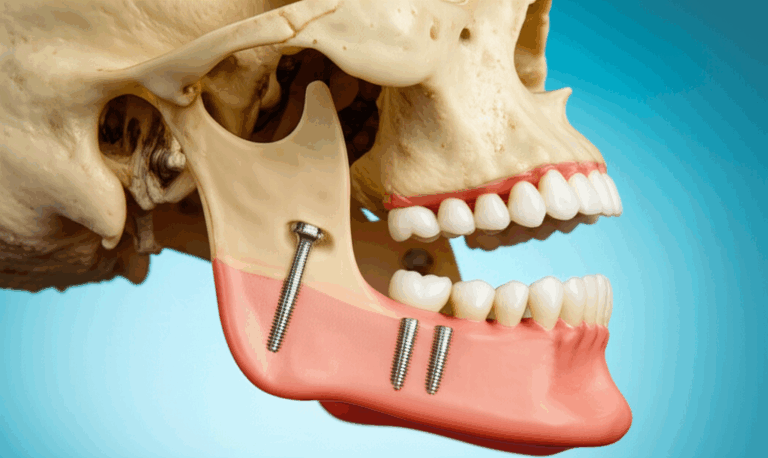

D. Implant-Supported Dentures (“All-on-4”)

Kind of a mix, using some implants to hold a whole denture in place.

- Sometimes covered, but ask your plan.

- You may still pay more for the surgery part.

Note: Some dental labs focus on these tooth replacement options. For more info on implant-supported options, implant dental laboratory sections explain these choices in plain language.

8. A Real-Life Example: How Coverage Might Go

It can be hard to picture how it all plays out. Here’s a simple example.

Case Study: John’s Implant Story

John, a 32BJ member, needs one implant for a lost molar.

- Dentist charges: $4,500 (for checkups, scan, implant, connector, crown)

- John’s plan: $50 deductible, $2,000 yearly max, 50% coinsurance for big stuff, 12-month waiting period (he’s waited enough), and pre-authorization needed.

What happens?

- John pays $50 first.

- $4,450 left.

- Insurance would cover half = $2,225.

- BUT, yearly max is $2,000—so plan pays only $2,000.

- John pays $2,500 ($4,500 – $2,000) plus the $50.

Lesson: The yearly cap usually matters most. If John did the crown next year, maybe another $2,000 would be paid.

This shows why it’s smart to plan, get pre-approval, and ask lots of questions.

9. Frequently Asked Questions

Are all dental implant costs paid for by 32BJ?

No. Usually, they pay:

- Part of the cost (often about half)

- Up to yearly limits (often $1,500–$3,000)

- Only after you pay your part and get pre-approved

- Only for real medical needs (not just for looks)

- Some things like bone work, scans, or temporary teeth may not be paid for fully

What if I need more than one implant?

Each implant and its parts count toward your yearly limit.

If you need a few, you might want to spread out the work over different years.

Do I have to use a dentist “in-network” with 32BJ?

You don’t have to, but using their dentists means you pay less. Outside dentists cost more, and insurance pays less.

Can I get a cost estimate ahead of time?

Yes. Your dentist sends in a pre-authorization, and you get an Explanation of Benefits (EOB) showing what the plan will pay and what you’ll owe.

What papers do I need to check my coverage?

- Your Summary Plan Description (SPD) or Booklet

- 32BJ Health Fund member website login

- Call to customer service

- Check out the dental care resources for easy-to-understand info

10. Your Healthy Takeaway: Making the Best Move for Your Smile

Here’s the bottom line:

- Dental implants matter for your mouth, your looks, and your confidence.

- 32BJ usually pays something, but every plan is different.

- Check your own plan—that’s rule number one!

- Get pre-approval for big treatment, so you don’t get stuck with surprise bills.

- Yearly and lifetime caps mean there’s a limit, so good planning can save money.

- There are other ways to replace teeth—bridges, partials, dentures—that might have better coverage.

Take charge:

- Read your plan, use the member website, call support, and ask your dentist to help you out.

- Don’t be afraid to ask questions. It’s your mouth—and your wallet.

Thinking of getting started? Great!

Insurance can be weird and confusing, but you’re not stuck. The more you learn, the more you get from your 32BJ plan—so you can eat, talk, and smile easy.

Useful Resources and Next Steps

Want to learn more about teeth and treatments?

Check out teeth information and teeth health guides for easy facts that help you make smart choices.

Curious about how crowns and bridges are made or want to see what goes on in a modern lab? Visit a crown and bridge lab for info about fixing your smile.

Remember: Every mouth, every smile, and every 32BJ plan is a little different. Look up your exact benefits, talk with your dental team, and start your dental implant journey with confidence—because you deserve to feel good.

Key words covered: 32BJ dental benefits, 32BJ implant coverage, union dental insurance, coinsurance, deductible, pre-authorization, yearly maximum, bone graft, dental implant choices, in-network and out-of-network, and more.

This article is for your info only and doesn’t replace your real plan description or your dentist’s advice. Always check your plan or speak to 32BJ for your exact info.